Leave a Legacy

"The importance of money essentially flows from its being a link between the present and the future." - John Maynard Keynes

On this page

Planning for the Future

Thank you for considering a legacy gift to King's.

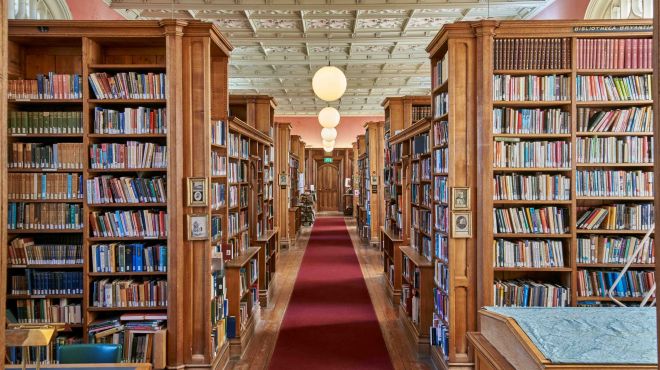

King Henry VI, the Founder of King’s College, left King’s its first legacy gift and since then the impact of legacy giving has been transformational. Legacy gifts have enabled King’s College to thrive, build and conserve buildings, provide opportunities for education and research, and enrich College life. Such generosity contributes significantly to the long-term financial security of the College.

Unrestricted gifts are the most flexible legacy and will be spent on the area most in need when a gift is eventually realised. They are 'future proofed'.

However, this is your gift and we are here to help facilitate your aspirations for it. If your motivation for giving derives from a specific area, experience or aspect of College life, we would be delighted to have a conversation about how to maximise the impact of your gift and ensure it is applied in keeping with your intentions.

Practical Reasons to Leave a Legacy

King's College Cambridge is a registered UK charity (1139422). Our charitable status ensures legacy gifts to King’s are exempt from paying Inheritance Tax (IHT). In addition, leaving a gift in your Will to the College may reduce your estate’s Inheritance Tax liability.

Since April 2012, if you leave 10% of your estate to charity, the tax due may be paid at a reduced rate of 36% instead of the standard 40%. Please do visit the UK government website for more information.

While King's College can advise on how to direct and apply your legacy gift to greatest effect within the College, we cannot provide formal, qualified legal or financial advice. You should consult a qualified and registered legal or financial practitioner to discuss your personal situation before making a charitable gift. If you do not already have an advisor, The Society of Trust and Estate Practitioners could be a useful starting point.

Types of Legacy Gifts

Residuary Legacy

A residuary legacy is the whole or a percentage share of what remains of your estate, once all gifts, debts, taxes and costs associated with it have been deducted. A residuary legacy allows you to provide for your family and loved ones first, while also remembering King’s.

A benefit of residuary legacies is that the value is unaffected by inflation as there is no fixed sum. As the value of your estate increases, so will the value of your legacy. Regardless of the size of your estate, a portion share will be gifted to King’s.

Pecuniary

This is a gift of a fixed sum of money. These types of legacies can often be affected by inflation and their value can decrease over time. However, you can choose to link pecuniary legacies to the Retail Price Index in order to safeguard the sum of your gift. You should consult your solicitor and/or accountant for full details on index-linking.

Reversionary

This allows you to pass your estate (or asset) to an initial beneficiary/ies (e.g. your spouse) and for them to have the benefit and enjoyment during their lifetime. After this time, the estate (or asset) is passed to a specified person or charity absolutely. Given the complexity of reversionary legacies, we suggest that you contact a legal advisor to discuss legacies of this nature.

Specific

This is a specific or non-monetary gift, for example stocks and shares, life assurance policies, property, books, fine art, special collections that you may feel will be beneficial to the College. It is important to talk to the College in advance of pledging a specific legacy to ensure that such an item can be accepted. The College reserves the right to decline items, or to sell them in pursuit of the College's charitable purposes.

Thank You

King’s College is exceptionally grateful for all legacy gifts. Thank you.

Irrespective of size, all legacy pledges are acknowledged. If you confirm a gift in writing, we would be pleased to recognise you as a member of the King Henry VI Legacy Circle and you will be invited to our annual legacy event. Your legacy pledge may also be eligible for further recognition. Please see our recognition page.

If you have included King's in your Will, please use the form below to let us know.

Legacy Pledge Form (UK and overseas)

You can also email legacies@kings.cam.ac.uk if you prefer.

Get in touch

Conversations are held in the strictest confidence.