Support King's

Your opportunity to make a difference.

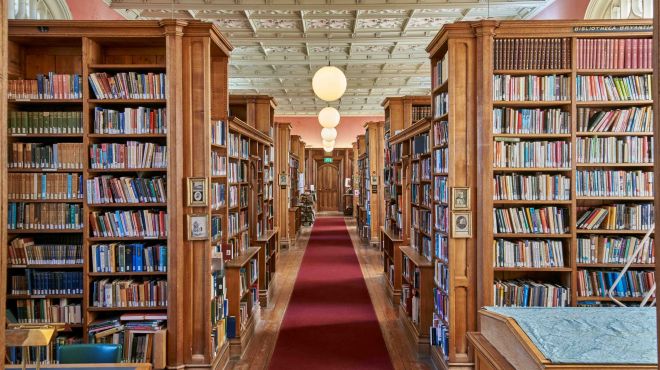

King's College is built on philanthropy. Ever since our foundation in 1441 by King Henry VI, the College has been sustained by generations of generous benefactors.

Gifts help us ensure that the opportunities King’s provides are available to anyone who is academically able, regardless of their background, and that our students are supported in all the ways they need throughout their time at Cambridge. They enable us to sustain academic excellence by supporting world-class teaching and research, and they support us in protecting and enhancing the College’s unique environment and cultural heritage.

The needs and aspirations for the academic life and estate of the College are many and varied, and your donation can make real difference. Some of our current priorities are listed below. If you have a particular area of interest not mentioned, please get in touch – we are always pleased to hear from you.

Lorraine Headen, Development Director

Current priorities

Discover where your donation can have the most immediate impact.

How to give

One-off donation

Single gifts can be made by cash, credit card, cheque, bank transfer or CAF Voucher.

To make a single gift, please complete the donation form, and send it with your gift to The Development Office, King’s College, Cambridge CB2 1ST. Cheques should be made payable to 'King’s College Cambridge'.

If you prefer, you can make a gift online and immediately via CAF, using a variety of debit and credit cards, or a Charities Aid Foundation account. Please use the links provided in the "Current Priorities" section above.

If you wish to make a bank transfer, please use the account details below:

Account Name: KING'S COLLEGE DONATIONS ACCOUNT

Account Number: 53962342

Sort Code: 20-17-68

IBAN: GB84 BARC 2017 6853 9623 42

SWIFTBIC: BARCGB22

Barclays Bank Plc

9-11 St Andrews Street

Cambridge

Please use your name as the reference as this will make it easier to ensure that the donation is properly accounted for. If you would like to allocate your donation to a specific fund, please email members@kings.cam.ac.uk once the transfer has been made.

Regular donation

Donations can be made by direct debit in monthly, quarterly or annual instalments, for a fixed or indefinite period. These donations are also covered by the Gift Aid scheme.

To set up a regular gift, please complete the donation form, and send it to The Development Office, King’s College, Cambridge CB2 1ST. Alternatively, you can also set up a regular gift online to the College via the Charities Aid Foundation . Please use the links provided in the "Current Priorities" section above, being sure to click the "I'd like to give regularly" box.

If you are a US donor, make a recurring gift with Cambridge in America for King's College.

Payroll Giving

Under the Payroll Giving Scheme, employees can authorise their employer to deduct charitable donations from their pay before calculating Pay As You Earn tax. This means that the employee automatically gets tax relief on donations at his or her top rate of tax. To find out more about Payroll Giving, please contact your Human Resources or Personnel department.

Matched Giving

Many companies in the UK, USA and Canada now operate gift-matching schemes. When an employee makes a charitable gift, the company matches this (in full or in part). To find out if your company operates such a scheme, and to obtain a copy of their matching gift form, please contact your Human Resources or Personnel Department.

Gifts of shares, property and tangible items

Gifts of land, buildings, shares and other possessions by UK tax payers, can attract full relief from Capital Gains Tax and, in addition, may allow the donor to claim Income Tax relief on the full value of the gift at the time ownership is transferred to the College.

The College may also from time-to-time accept gifts of tangible objects such as paintings, objets d'art, furniture, books and papers. These are typically accepted at the discretion of the Adornment Committee, Librarian or Archivist, and the College reserves the right to decline or sell such objects in pursuit of its charitable purposes.

To make a gift of shares or property of any type, please contact the Development Office, which will be pleased to assist.

Donating from outside the UK

If you are making a donation from overseas you may be entitled to claim tax relief on your gifts in your home country. We have arrangements in place with the USA, Canada, and many European countries.

For more information about making donations from overseas, see our information on tax-efficient giving.

Leave a legacy

Legacy gifts have enabled King’s College to thrive, build and conserve buildings, provide opportunities for education and research and enrich College life. Read about Legacy Giving by clicking this sentence.

For more information or to start a conversation, please email Amy Ingle – Legacy Officer or call +44 (0)1223 331481.